This article describes how much it is necessary to pay customs if you order the goods on Aliexpress.

Contents

- Purchases for Aliexpress to Russia with customs clearance of goods in 2022: customs tax, limit, payment amount

- How is the customs duty for the parcel with Aliexpress is paid if the limit is exceeded?

- Documents for customs clearance of goods with Aliexpress: List

- Aliexpress - customs clearance, customs rules

- What other contributions, except for the fee for exceeding the limits, it is necessary to pay for the parcel from Aliexpress when customs clearance?

- Examples of tax calculation for the advantage and the amount of the order with Aliexpress in 2022

- Video: customs restrictions on purchases from China 2020-2022

Currently, China is the main supplier of goods for most entrepreneurs of Russia. Aliexpress It is in demand thanks to a large assortment and low prices.

- Each buyer Ali must know that the number of orders by weight and amount on this trading platform is limited, since customs may require tax payment.

- The restrictions are not set Aliexpress, and the customs service.

- What are the rules in this service? What is the amount of tax and what documents are needed for registration? You will see all the necessary answers in the following article.

Purchases for Aliexpress to Russia with customs clearance of goods in 2022: customs tax, limit, payment amount

So, how to make purchases on Aliexpress To Russia with customs clearance of goods? Customs rules regarding goods with Aliexpress have not changed since 2020.

If the limit is exceeded, on the border in 2022, you will have to pay the customs tax in the following amount:

- 15% for excess of the amount 200 euros for one parcel.

- 2 euros for weight excess over 31 kg in one package - For every extra kilogram.

- Limit for parcels per month, as practiced in 2019, now not. You can make orders an unlimited number of times a month, but it is smart that you are not recorded by customs services, as for entrepreneurship. It is better to make orders for your friends if you order a lot of identical products.

- All countries that are in the Customs Union pay for customs. In some countries, such as ours, the requirements are more loyal in comparison with others. For example, in Belarus, buyers of Chinese stores will pay a compulsory customs fee of 5 euros and also 15% from the amount of limit excess. It is also allowed to import in this country from abroad at a time only 10 kilograms of goods and worth 22 euros-for the rest of the weight you will have to pay 2 euros for each extra kilogram. They also have a restriction per month, no more than 200 euros and 31 kg.

How is the customs duty for the parcel with Aliexpress is paid if the limit is exceeded?

If customs does not have any questions for you, then a receipt is automatically filled out to pay for the fee.

- If the goods came by mail of the Russian Federation, then pay the receipt when receiving the parcel in the post office.

- If the courier delivered the package, then the receipt will also be with him and it needs to be paid.

- If an SMS or email came, where there is a link to the completed receipt form, then it must be paid online.

Documents for customs clearance of goods with Aliexpress: List

If customs have questions for your package and you were told the address where you should go for the package, then you can either refuse the parcel and it will return to the seller, and you will open the dispute or pass the design.

If you still decide to pick up your goods and are ready to pay the customs tax, then prepare such documents:

- Photocopy of all pages of the passport.

- Certificate from a banking institutionIn which calculations for the goods are reflected. This is possible only if the purchase was paid from the card account. If you paid for the goods from the account of the electronic wallet, then you will have to prepare the screen of this monetary operation.

- If you bought equipment, customs has the right to request notification. Look for her on website of the Eurasian Economic Commission.

- Order screenshot on the site Aliexpress.

- If you bought a product at a discount, then you need to provide evidence that the goods were purchased at a lower cost.

- Filled application indicating the purpose of purchasing goods (write only the truth).

Advice: If you don’t want to collect documents, then you need to send a letter to the customs service with consent to evaluate the goods by customs specialists.

But in this case, you should know that the value of the goods may differ significantly from the one you paid to the seller. Because of this, the customs duty will be much higher than if you provide documents.

Aliexpress - customs clearance, customs rules

All customers Aliexpress I would like to purchase goods without paying customs tax. But this is impossible, since certain customs rules apply:

- The package should contain goods for personal use. If customs officers consider that the goods are related to commercial activities, then the recipient will have to pay tax.

- Customs officers "shine through" each parcelAnd if they find several units of the same product there, then the buyer may come to pay tax.

- When ordering goods in different stores, you will receive several packages. If you order different goods, but in one store, then the seller can put the goods in one parcel, and this will already cause suspicion of the customs service.

- Ask the seller to put the ordered goods into different parcelsSo that the customs does not appoint tax.

The process of customs clearance takes no more than 15-20 minutes. But this, if there are no queues at the design point, otherwise you will have to wait within 1-2 hours. You can pay for the fee in the department of any banking institution. After paying, make a photocopy of receipt. For customs officers, the original will be needed, and the copy should be stored with you.

What other contributions, except for the fee for exceeding the limits, it is necessary to pay for the parcel from Aliexpress when customs clearance?

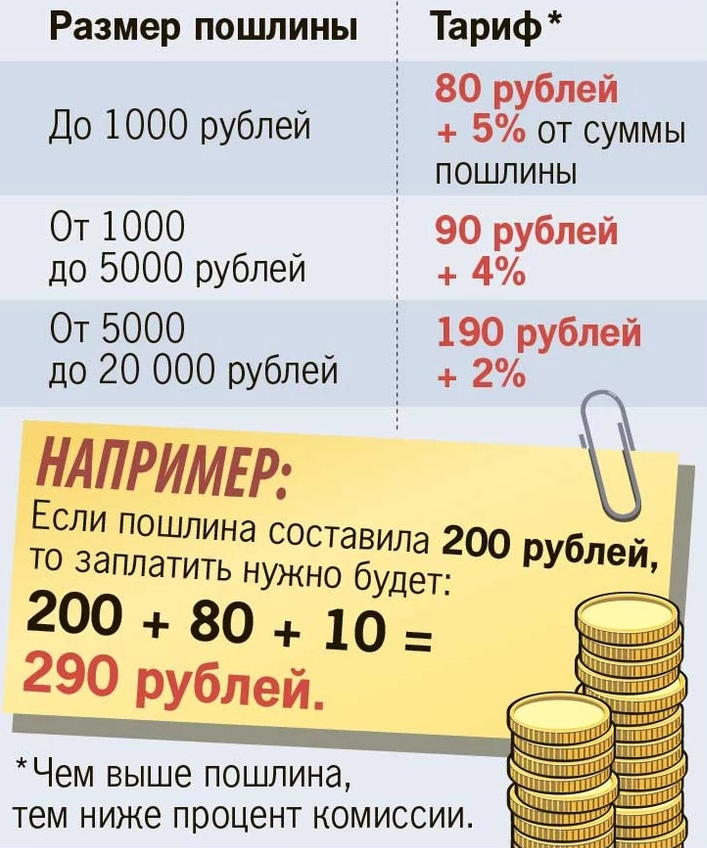

- In addition to the fee for excess of value, or by the weight of the parcel, it is necessary to pay the commission of the Russian Federation, for the services of registration at special postal fares. This is with postal delivery. But keep in mind if you pay the fee online, then the commission does not need to pay by mail.

The picture below is an example of such an operation.

- When delivering a parcel by a transport company - a private carrier, this is express delivery, delivery by courier, then a customs fee will be accumulated. In 2022 it is 500 rubles.

Examples of tax calculation for the advantage and the amount of the order with Aliexpress in 2022

Let's look at payments from parcels to Russia when exceeding the customs limit using an example:

- A businessman from our country ordered techniques for Aliexpress in the amount of 240 euros, and weighing 30 kilograms. Excess turned out in total. We make such calculations: 240 euros - 200 euros (permissible amount) \u003d 40x 15%=6 euros is the size of the customs tax.

- The owner of a clothing store in the city of Saratov ordered Aliexpress goods weighing 36 kilograms in the amount of 198 euros. By sum, the indicators are not exceeded, and the weight will have to pay tax: 36 kg - 31 kg (permissible weight) \u003d 5 kgx 2 euros=10 euros - you need to pay customs.

- If the indicators are exceeded by both signs, then calculations are made on them, and the largest amount is paid. For example: a resident of Russia ordered goods in the amount of 410 euros weighing 40 kilograms in one package. Exceeding the limit was obtained both by sum and weight. We make calculations: by sum - 410 euros - 200 euros \u003d 210 eurosx 15%=31.5 euros. By weight: 40 kg - 31 kg \u003d 9 kgx 2 euros=18 euros.

A resident of Russia will pay 31.5 euros (large amount).

In addition to these calculations, remember about the customs fee of 500 rubles or a postal commission that may be added to these amounts.

Now you know how much you can purchase goods on Aliexpressso as not to pay tax. If nevertheless it is not possible to order less than the established limit, then collect all the necessary documents in advance and calculate the amount of the fee that you will have to pay.

Successful shopping!

Video: customs restrictions on purchases from China 2020-2022